"Wealthy Nations Become Service Economies" is Just Plain Dumb

Maintaining wealth means defending freedom, so long-term successful economies must retain manufacturing

‘Round about the time I was exhorted by a college career adviser decades ago not to go into manufacturing because it offered no career future, it was also common “wisdom” that the natural progression as nations grew wealthy is that they outsource production and focus on services.

There is almost no logical basis for that assertion. Now, manufacturing may naturally make us less of total GDP, as we do less busy work ourselves and rely increasingly on service providers for it. But that in no way implies that we have to send industry overseas.

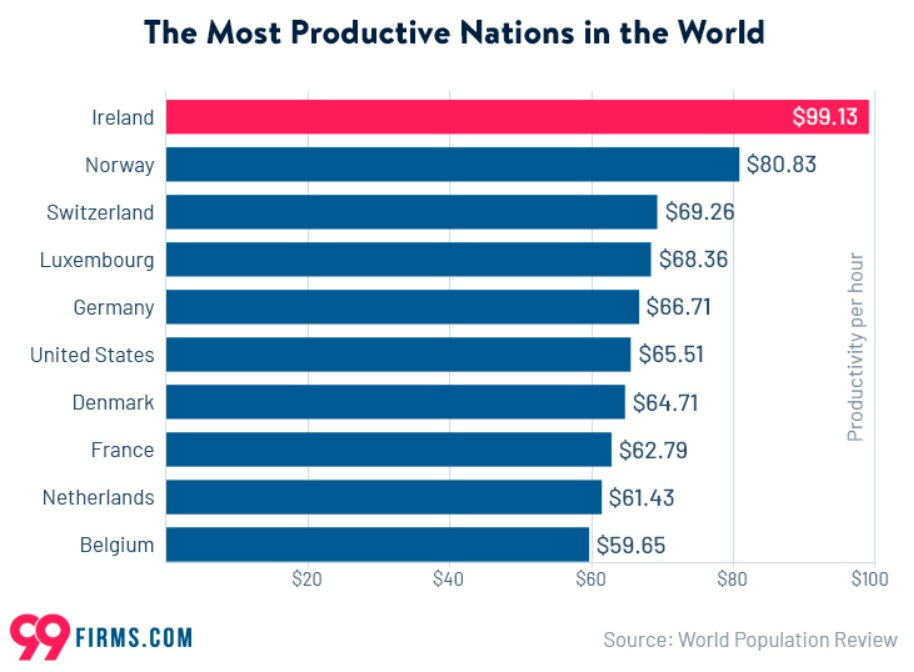

The one rationale that makes any sense at all is that the citizens of wealthier nations demand higher salaries. On its face that makes sense, and there is certainly some truth there. But also true is that wealthier nations are also more productive, and it’s that productivity increase that drives higher pay. Of course, if you also have an insane welfare state and pay people on the bottom of the income ladder NOT to work, as the Western world increasingly does, that’s a whole other perversion. It’s part of what we’re going to have to tackle as we work to bring our offshored production back.

If I was given to conspiracy theories (and I am, given enough verifiable evidence), I’d say that the “wisdom” of the service economy, coming as it did at the same time that extremists took over the promulgation of critical policies like environmental and safety regulations, was just cover for offshoring not just our production but our pollution and risk. That pernicious little fact that it also offshored millions of good-paying jobs, primarily in our rural areas? That wasn’t a concern of the extremists.

So now we find ourselves, after thirty or forty years of “growing” into a primarily service-based economy, in a bit of a pickle. We make almost no ships. We mine, process, and refine less and less of our needed metals, and very little of the most critical ones. Hell, we can’t even make our own damn underwear anymore. And who do we rely on most? The country that has become our #1 geopolitical rival.

Yeah, that was smart.

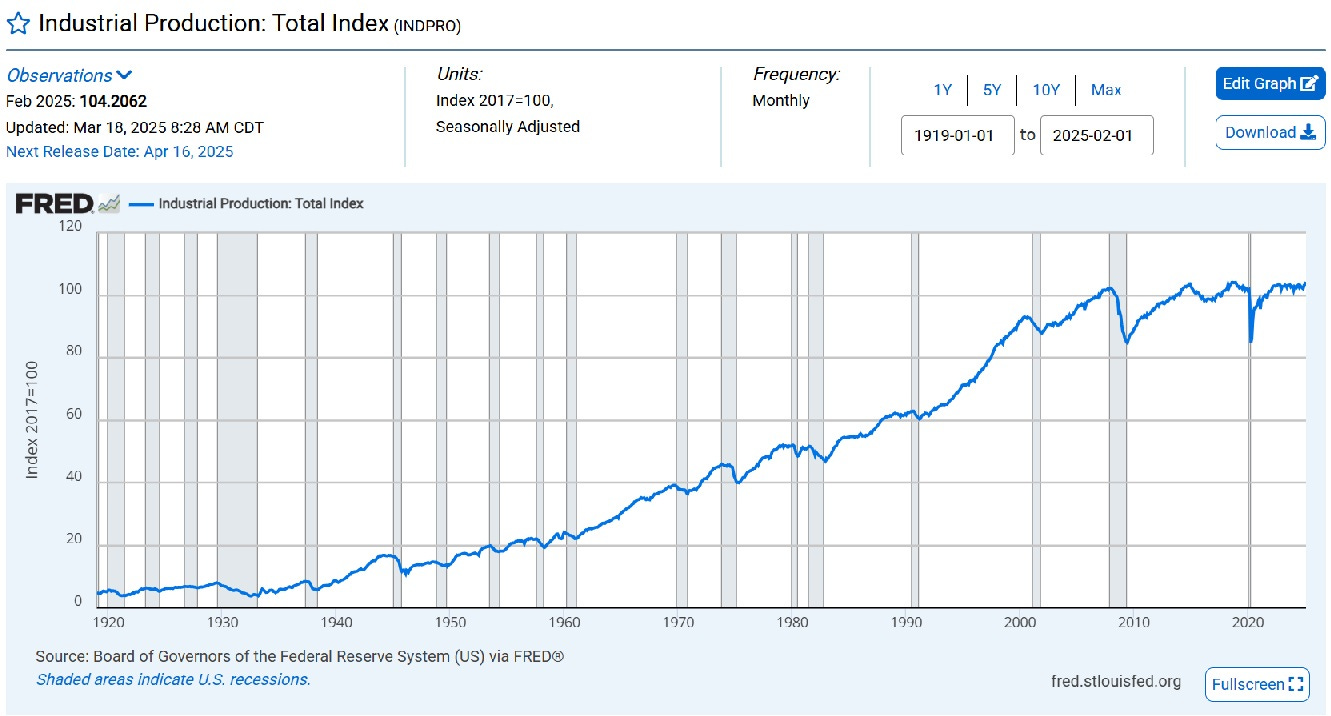

Now it’s not all doom and gloom. I was reading a very good article recently by economist/engineer (what a great combo) Peter Earle, and one jarring note in his superb piece is that he wrote of bringing “large-scale manufacturing” back to America. Here’s the thing: America has large-scale manufacturing, loads of it. As I pointed out in my Substack a couple weeks ago, our enormous industrial output continued to grow even as we outsourced whole segments of industry.

The trouble is that it completely stopped growing more than fifteen years ago. Funny… that’s right around when China overtook us as the world’s top manufacturer.

The US worker remains one of the world’s most productive, while China’s don’t even make the chart. (This is general productivity. I’m searching for manufacturing-specific figures and will share those when I find them.)

It turns out we had some dodgy financial comparisons that reinforced the nonsensical “this is just how it goes” argument I spoke of above. Michael Kinder, CEO of the on-demand labor app company Veryable, wrote an excellent piece covering one angle of that recently.

Another was explained by author, academic, and innovation guru Clayton Christenson in his book How Will You Measure Your Life?, the application of which I used in last week’s post about the bicycle industry’s offshoring antics. Here are more details from the accounting end:

Wall Street analysts hawkishly monitor financial metrics and ratios that track the “efficiency” of capital used in a business. One particularly common one is RONA, or Return on Net Assets. In manufacturing businesses, this is calculated by dividing a company’s income by its net assets. Hence, a company can be judged as being more profitable either by adding income to its numerator, or by reducing the assets in the denominator. Driving the numerator up is harder, because it entails selling more products. Driving the denominator down is often easier–because you can just opt to outsource. The higher the ratio, the more efficient a business is judged to be in using its capital.

In other words, our economic “geniuses” devised a profitability measure that by its very nature discouraged owning any production assets. Brilliant…

So no, we don’t need to bring large-scale manufacturing back to America. We need to look at how those successful manufacturers already doing it here are profiting even with all the roadblocks we’ve thrown in their way, and make that a whole lot easier. Meanwhile, we should also be removing the barriers that are making things difficult or impossible for our small and medium-sized businesses that make up around 98% of our existing manufacturing base.

America should be the wealthiest economy AND the world’s leading manufacturer. I’m confident that, despite what the “experts” told us a few decades ago, we can do both.

Not really. As people become more affluent, they’re often more willing and able to spend on restaurants, entertainment, travel, and other services. Contrary to the claim that U.S. manufacturing has been “hollowed out,” the sector has grown substantially. In inflation-adjusted terms, the value of U.S. factory output is more than two-and-a-half times what it was in 1970.

However, manufacturing has declined as a share of the overall economy — not because it shrank, but because other sectors grew faster, including some that barely existed in 1970, such as information technology and digital services, and some that didn’t exist at all, like cellular telecommunications.